网络环境下众筹融资影响因素的研究(附原始数据表)

无需注册登录,支付后按照提示操作即可获取该资料.

网络环境下众筹融资影响因素的研究(附原始数据表)(论文15000字)

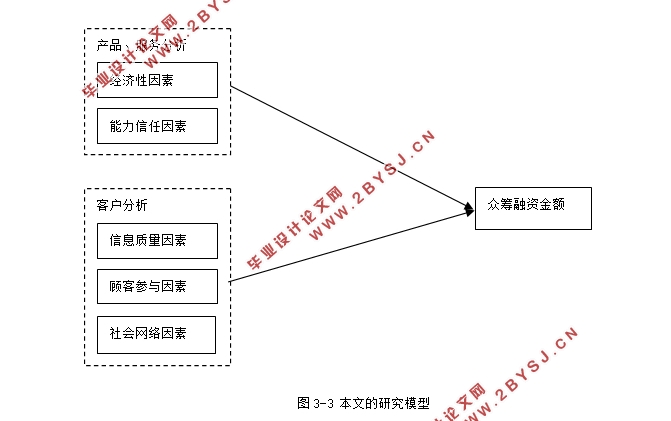

摘要:本文通过查找大量的文献,研究和吸取之前研究者关于众筹方面的研究理论、众筹模式下消费者心理等多方面的研究成果,加上对网络众筹平台这一新平台的使用,构建了基于对众筹融资金额影响的五个方面因素:经济性因素、能力信任因素、信息质量因素、顾客参与因素和社会网络因素。这些因素共包含众筹项目中是否存在明确的折扣信息、项目发起人是否是团队身份、项目发起人是否具有成功经验、项目介绍中是否添加视频、项目话题数量和项目支持者人数六个变量。通过网络获取数据,之后利用数据统计软件对数据进行描述性分析、显著性检验、回归分析,验证本文假设,得出此类结论:上述五个因素均对众筹融资金额存在正向的影响关系。但在这些因素中顾客参与因素对众筹项目的融资影响最大。

关键词:众筹;众筹融资;顾客参与;最优尺度回归

Study on Factors Affecting the crowdfunding for financing under the Network Environment

Abstract:In this paper, by finding a large number of documents, prior to the study, drawing on a wide range of information on the theoretical aspects of crowdfunding and the consumer psychology in crowdfunding mode,coupled with the use of crowdfunding platform,we build on five factors based on crowdfunding financing:Economic factors, ability trust factors, information quality factors, customer participation factors and social network factors.These factors contains information on whether there is a clear discount crowdfunding project, the project sponsor is whether the identity of the team, the project sponsor whether successful experience, project description is added with the video, the number of project topics and project the number of supporters six variables . Get the data through the network, and then use statistical software for data descriptive analysis, significance test, regression analysis, this article assumes that verification, draw such a conclusion: the above five factors are present positive impact on the relationship between the amount of financing crowdfunding . But these factors are the factors involved in customer financing the biggest impact on the crowdfunding projects.

Keywords:crowdfounding;crowdfunding financing;customer participation;optimal scaling regression

目 录

摘要......................................................1

1 绪论....................................................1

1.1 研究背景..............................................................1

1.2 研究目的及意义........................................................2

1.3 研究内容..............................................................2

1.4 研究思路..............................................................3

2 文献综述................................................5

2.1 众筹的研究综述........................................................5

2.1.1 众筹的概念和特点................................................5

2.1.2 众筹的国内外相关研究............................................5

2.2 众筹主体行为机制研究..................................................6

2.2.1 众筹投资者的动机................................................6

2.2.2 影响众筹项目成功的因素..........................................6

3 构建模型及研究假设......................................6

3.1 构建模型..............................................................6

3.2 研究假设..............................................................8

3.2.1 经济性因素与研究假设............................................8

3.2.2 能力信任因素与研究假设..........................................8

3.2.3 信息质量因素与研究假设..........................................9

3.2.4 顾客参与因素与研究假设..........................................9

3.2.5 社会网络因素与研究假设.........................................10

4 研究设计及数据收集.....................................10

4.1 数据来源.............................................................10

4.2 数据收集.............................................................13

4.3 变量说明.............................................................13

5 数据分析及假设检验.....................................14

5.1 描述性统计分析.......................................................14

5.2 显著性检验...........................................................15

5.3 回归分析.............................................................15

5.4 研究讨论.............................................................17

6 研究结论及展望.........................................18

6.1 研究结论.............................................................18

6.2 实践启示.............................................................18

6.3 研究不足和未来展望...................................................18

参考文献.................................................20

附录.....................................................22

致谢.....................................................33

Abstract.................................................34